Recently, Sol Analytica evaluated the financing options for a short-term small business loans. We found that American Express Blueprint – formerly the fintech started Kabbage before the Amex acquisition – offers a unique approach to payments and interest schedules. This different approach can be confusing, but also offers opportunities to businesses that understand the structure, and some dangers to those who don’t. Since we’re a data and data viz company, what better way to help people understand than with a few simple data vizzes!

Small Business Loans

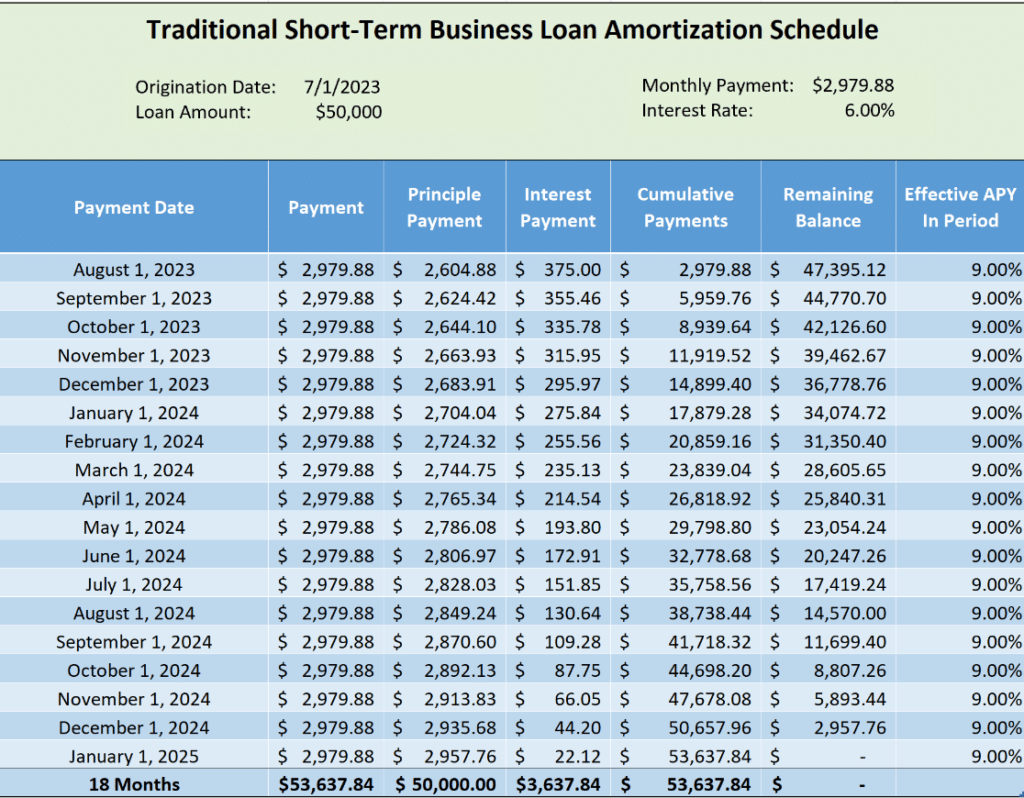

Businesses sometimes need supplemental cash for growth, or to cover uneven expenses. Banks offer small business short-term loans and love to charge businesses interest for the privilege of using the money. Traditionally, the lenders amortized loans so borrowers pay a fixed interest rate for the duration of the loan. The borrower pays down interest as the loan matures. Each installment covers a larger amount principle and a smaller amount of interest than the previous payment. This is similar to how a traditional mortgage works, but on a much shorter time scale. Here’s an example amortization schedule for a $50K loan at 9% over 18 months:

With this traditional loan structure, if the borrower makes additional payments, it immediately reduces the amount of principle and the the total interest payment on the next installment will be lower and it decreases the duration of the loan.

Blueprint is “Special”

American Express Blueprint doesn’t charge interest. Instead, they charge a monthly fee for the duration of the loan in lieu of interest. The fee is based on the borrower’s credit, the borrowers cash flow and some fancy AI. We were quoted a fee of 3% on a 6-month loan, 6% on a 12-month loan or 9% for an 18-month loan.

At first blush, this looks like a 6% interest rate, but it isn’t. We were surprised to see that the actual APY over the course of the loan was well over 10%. In fact, for an 18-month loan with a 9% fee, the total interest payments were equivalent to a traditional loan with an 11.1% interest rate!

How is that possible? When building your amortization schedule, Amex calculate a total amount due and divides it into even monthly payment. With each successive payment, the outstanding principle is lower but the dollar amount of fee stays the same. The effective interest rate climbs higher with each payment. By the final installment, the effective interest rate can be over 100%. Here’s that same amortization table but on a Blueprint loan:

The initial rate of 6% is a terrific rate in the current interest rate environment. By the 6th month of this 18-month loan, the interest rate is comparable to most other small loans, but later it becomes expensive money. In the example above, 21% by the 14th month is a less favorable rate than most balance carrying credit cards. Would you accept a 1-month loan with an effective interest rate of 108% interest rate on $3,000? Notice that on a loan of $50,000 the traditional loan charges a total of $3,600 of interest, while on the Blueprint loan it is $4,500 of interest.

Optimizing Your Loan

This doesn’t mean you should avoid Blueprint loans. In fact, after this research, we elected to utilize our line of credit. So what can you do to optimize the use of an American Express Blueprint loan?

- Maximize duration of the loan. An 18-month loan takes longer to get to unfavorable rates. If you need $10K for 6 months, take out a $10K 18-month loan and pay it off in the 6th month.

- Pay off the loan early. Paying off the loan after the first several months allows you to take advantage of the great rate at the beginning, and skip the the less favorable rates in effect at the end of the loan period. A bonus: once you pay this loan off, your credit line is refreshed. You can pay off the loan early then take out a new loan and reset the amortization calendar.

- Do not do a partial payoff. Early payments do not reduce the amount of fee you will be charged monthly, so the net impact of making an early payment is actually that your effective interest rate is higher AND you have less cash in your business.

- Only utilize 60% of your available credit line. This gives you the space to “roll” your 18-month loan at the 6-month mark.

- If you do not anticipate being able to pay off your loan early, consider a traditional small business loan with a regular amortization schedule instead

Small Businesses Unite

You’re probably finding this because you face making important decisions for a small business. As Sol Analytica grows in the small business network, we find great appreciation for the communities willingness to lift each other up; whether it be sharing knowledge, advice, or a resourceful contact. Accepting a loan is one examples of the many strategic decisions small businesses face.

Sol Analytica encourages you to turn your data into actionable insights that will guide your small business down the right path: growth. We’re passionate about integrating data and analytics through out organizations, such as tracking marketing strategy through KPIs or adjusting business processes with user data. Have you adopted the optimal data strategy for your organization and industry? How confident are you in your KPIs and data integrity? Every small business is unique and requires a unique, well engineered and governed data strategy. That is what we do. Sol Analytica provides the knowledge and tools for organizations to navigate a data strategy, monetize data, and empower growth. Send us a note to info@solanalytica.com or give us a call at (424) 350-5184 to chat about asking the right questions with your data. From one small business to another, let’s chat!

Recent Comments